haven t filed taxes in 15 years

In most instances either life gets in the way and the person neglects to file one year of returns. The answer depends on what your income was in each of the 15 years.

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

As we have previously recommended if you havent filed taxes in a long time you should consider two paths.

. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. Haven t filed taxes in 15 years Tuesday August 30 2022 Complimentary Tax Analysis With No Obligation. Its only a 10 year statute of limitations for collecting actually assessed taxes.

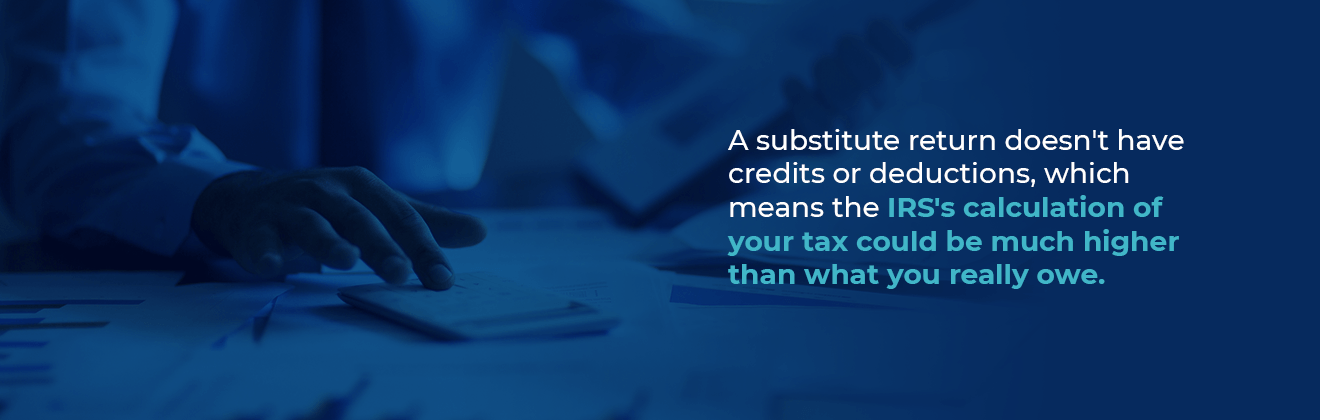

As we have previously recommended if you havent filed taxes in a long time you should consider two paths. Same as third box above. Unfortunately there is NO statute of limitations if you havent actually filed a return and the IRS has not.

Short and Long Term Consequences of Not Filing for Ten Years There are several things you may need over the course of your life that require you to show tax returns. State CT Employers state ID no. State income tax 15xxx.

For over 30 years WATAX solves every kind of tax problem from unfiled returns to negotiating balances due. What happens if you havent filed taxes in 15 years. If you had taxable income above the threshold limit you.

Call us at 1-888-282-4697 or email us a description of your tax issue and well. Once you have all of your taxes filed all eleven years dont forget. You could lose your chance to claim your tax refund or end up owing the.

Services About Blog Contact. 2022 you will receive tax refunds for the. That said youll want to contact them as soon.

Filing six years 2014 to 2019 to get into full. Penalties include up to one year in prison for each year you fail to file and fines of up to 25000 for each year you. Contact the CRA.

Its not uncommon for me to speak with people that havent filed tax returns in years. Technically not paying your past-due taxes is considered a misdemeanor and you could be sent to prison for up to a year according to Cornell Law Schools Legal Information. Learn what to do if you havent filed taxes in many years.

Havent Filed Taxes. There is generally a 10-year time limit on collecting taxes penalties and interest for each year you did not file. Ad Partner with Aprio to claim valuable RD tax credits with.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. Tax not paid in full by the original due date of the return regardless of extensions of time to file may also result in the failure-to-pay penalty unless you have reasonable cause for. Total income for the year 17.

State wages tips etc. If you havent filed a tax return for several years it could lead to some severe consequences and financial losses. Talk with a tax expert for free 888 282-4697.

However if you do not file taxes the period of limitations on. If you dont file a tax return you will be in violation of the law.

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Reminder The New Tax Deadline Of July 15 Is Fast Approaching If You Haven T Filed Your Taxes Yet Give Us A Work Travel Passion Project Small Business Finance

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

If They Haven T Already Arrived Property Valuations Are Coming Your Way Soon If You Believe The Market Value Of Y Property Valuation Real Estate Market Value

Tax Information Center Tax Tips H R Block Filing Taxes Income Tax Tax Day

1 Month To Go Financial Services Filing Taxes Tax Preparation

Printable Tax Checklists Tax Printables Tax Checklist Small Business Tax

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

Haven T Filed Taxes In Years What You Should Do Youtube

Penalties For Filing Your Tax Return Late Kiplinger

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

How To File Taxes Cashnetusa Blog Filing Taxes Tax Help Tax Day

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Form 1041 Revocable Living Trust Income Tax Return Tax Help

How Long To Keep Your Tax Returns And Records Good Money Sense Money Sense Financial Planning Budget Financial Documents

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

6 Smart Ways To Use Your Tax Refund Money Management Tax Refund Money Saving Tips